How Likely Is Gdax to Crash Again

Yesterday, a market where people trade the Bitcoin-like cryptocurrency Ethereum crashed instantly.

The value of Ether (the Ethereum currency) plunged from most US $300 to $0.ten in seconds. Then it bouncing right support to $300.

Here's how this extremely unlikely event unfolded:

- Around 12:xxx pm PST the price of Ether — which had been trading on the GDAX currency exchange at effectually $300 — suddenly dropped to $0.ten. The official caption is that a trader placed a multi-meg dollar order to sell Ether.

- In the chaos, computers sold off Ether in automated, toll-triggered "sell" orders. Traders lost millions of dollars.

- Only 1 trader had an automated "purchase" order telling computers to buy three,809 Ether if it e'er dropped and then low as $0.10.

- Within a few minutes, the price of Ether completely recovered to around $300. This meant that the three,809 Ether the trader had only bought was now worth $1,142,700. The trader had fabricated a 300,000% return within a few minutes.

Nosotros've had "wink crashes" similar this before (2010'south sudden Dow Jones toll drib of 9%). But cypher of this magnitude, where an asset lost 99.96% of its value in a matter of seconds.

And in instance you lot're wondering, no — GDAX is not issuing refunds or reversing any of these trades. Here'south their official explanation of what happened.

Update from GDAX : "We will establish a process to credit customer accounts which experienced a margin call or cease loss social club executed on the GDAX ETH-USD order book as a direct result of the rapid toll motility."

All this leaves some lingering mysteries:

- Why did the price of ether crash so all of a sudden and and so completely? Did someone intentionally dispense the market with the multi-million dollar sell order?

- Why didn't GDAX take countermeasures in place to stop trading in one case the cost started falling? If these countermeasures were indeed in place, did they fail to kick into upshot?

- Did the person behind this extremely profitable trade create the $0.10 purchase lodge every bit office of some broader strategy of exploiting extremely unlikely black swan events? Or did they merely create information technology as a practical joke, never expecting for the cost of Ether to drop that low?

- Who were they? Did the same person identify both the multi-million dollar sell order and the buy order at $0.10 knowing it would crash the system? Since the holders of Ethereum "smart contracts" are bearding, we may never know.

You tin read how cryptocurrency traders reacted to this transaction here.

And if you desire to read more about algorithmic trading, I highly recommend Michael Lewis'south volume Flash Boys: A Wall Street Revolt.

Here are iii other links worth your time:

- What I learned from Apple rejecting me for a scholarship to the WWDC (6 minute read)

- I burned my first startup to the basis. Here are some hard lessons learned (ix minute read)

- The latest video in our series about Active software evolution: The Definition of Gear up (iii infinitesimal watch)

Idea of the twenty-four hour period:

"The crytpocurrency customs hasn't decided whether they want to exist agitator rebels or to replace the establishment." — Adi Shamir

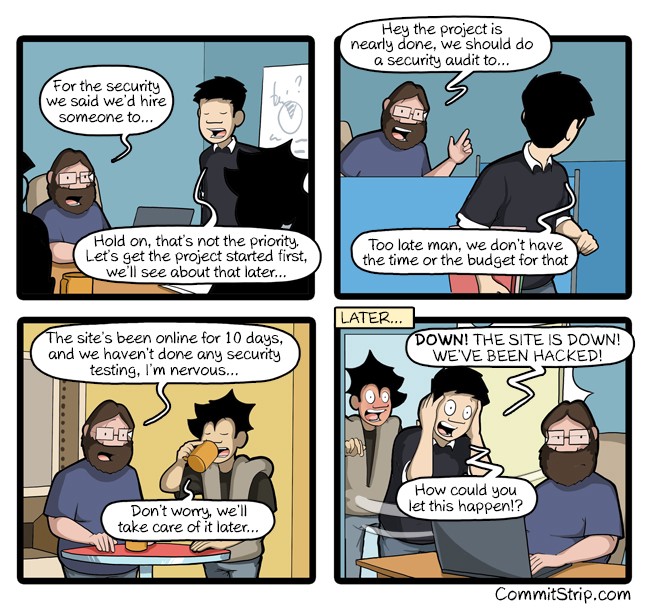

Funny of the day:

Webcomic by CommitStrip.

Study group of the day:

freeCodeCamp Buenos Aires

Happy coding!

– Quincy Larson, teacher at freeCodeCamp

If you get value out of these emails, delight consider supporting our nonprofit.

Learn to lawmaking for free. freeCodeCamp's open source curriculum has helped more than than 40,000 people get jobs as developers. Get started

petherickacketwound.blogspot.com

Source: https://www.freecodecamp.org/news/one-ethereum-trader-just-made-1-140-000-in-seconds-thanks-to-an-epic-glitch-48af7e0ffe49/

0 Response to "How Likely Is Gdax to Crash Again"

Post a Comment